GST compliance is one of the most confusing and time-consuming parts of running a restaurant. Tax rates change, invoices must be accurate, and even small billing mistakes can lead to penalties or customer disputes.

Many restaurants still rely on manual billing or loosely connected systems, which makes GST management harder than it needs to be. This article explains how automated restaurant billing software simplifies GST compliance and reduces reporting errors.

Why GST Billing Is Challenging for Restaurants

Restaurants deal with multiple billing complexities, including different tax rates for dine-in and takeaway, service charges, discounts, and high transaction volume during peak hours. Handling all this manualy increases the risk of mistakes.

Common GST Billing Errors in Restaurants

Incorrect Tax Calculation

Manual billing often leads to:

- Wrong GST percentage applied

- Missed tax components

- Inconsistent tax treatment across bills

These errors can cause compliance issues and customer dissatisfaction.

Missing or Incomplete Invoices

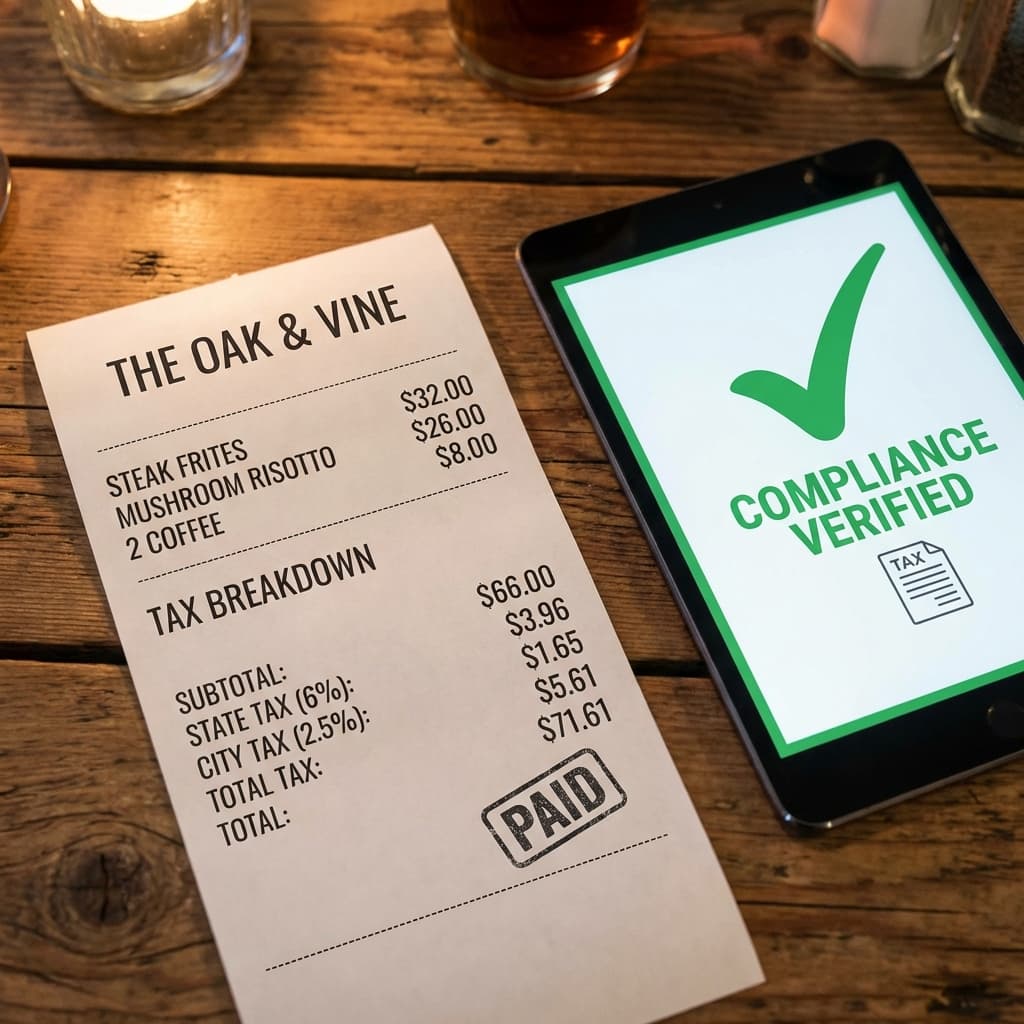

GST regulations require proper invoice numbers, accurate tax breakup, and clear item-wise pricing. Incomplete or incorrect invoices create problems during audits and returns.

End-of-Day Reconciliation Issues

When billing systems are not automated, cash and online payments don’t match, and sales reports differ from invoices. Manual reconciliation takes hours, wasting management time and increasing stress.

How Automated Restaurant Billing Solves GST Problems

Automatic Tax Calculation

Modern restaurant billing software automatically applies correct GST rates, calculates tax per item, and adjusts totals instantly when prices change. This removes guesswork and reduces compliance risk.

Simplify your taxes

Automate GST compliance with Epitto's billing software.

Get Compliant Nowarrow_forwardGST-Ready Invoices

Automated billing systems generate standardized GST invoices with item-wise tax breakdowns and sequential numbers. Invoices are always audit-ready.

Real-Time Sales and Tax Reports

With integrated billing and ERP software, restaurants get daily GST summaries allowing for clear separation of taxable values. This makes filing returns faster and more reliable.

Why GST Compliance Needs ERP Integration

Billing alone is not enough for proper compliance. When billing is integrated with a restaurant ERP system, orders, invoices, and payments stay synchronized. Revenue data is accurate and traceable. ERP integration ensures long-term compliance, not just correct bills.

Is Automated Billing Worth It for Small Restaurants?

Yes. Even small restaurants benefit from fewer billing mistakes, faster GST reporting, and less dependency on manual checks. Automation reduces risk regardless of restaurant size.

Final Thoughts

GST compliance should not slow down restaurant operations. Automated restaurant billing and ERP software removes complexity by handling tax calculation, invoice generation, and reporting automatically.

For restaurants looking to stay compliant while focusing on service and growth, automation is not optional—it’s essential.